Spaces at c4DI

Discover the Right Space for You

Whether you’re a freelancer looking for an inspiring coworking community, a growing startup in need of flexible office space, or a business seeking a professional setting for your next meeting – C4DI offers spaces designed to help you thrive.

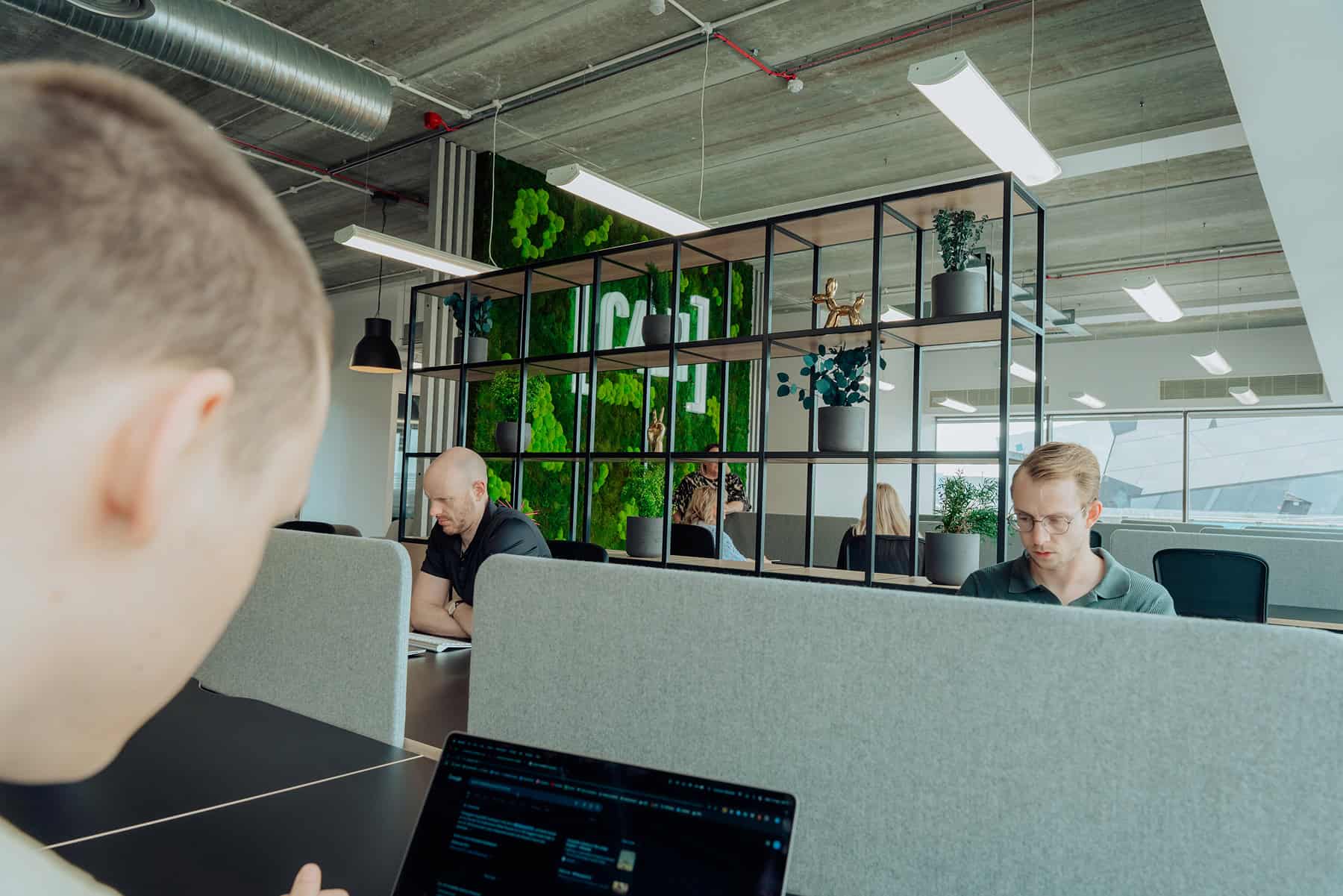

Coworking

Join a vibrant community of tech innovators, creatives, and entrepreneurs. Our coworking spaces are more than just desks – they’re a launchpad for ideas, collaboration, and growth. Enjoy super fast Wi-Fi, breakout areas, great coffee, and the chance to connect with like-minded professionals every day.

Ideal for: Freelancers, remote workers, startups, and small teams.

Meeting Rooms

Need to host a client presentation, workshop, or team strategy day? Our fully-equipped meeting rooms provide the perfect setting, with flexible layouts, AV equipment, catering options, and on-site support.

Ideal for: One-off bookings, recurring sessions, and external events.

Offices

Scale your business with purpose-built offices in the heart of Hull’s tech hub. From private suites to full-floor layouts, our offices are tailored to support teams of all sizes. Enjoy 24/7 access, meeting rooms, reception services, and access to the wider C4DI network of mentors and partners.

Ideal for: Startups, SMEs, and innovation-driven businesses ready for the next step.

Corporate

For larger businesses looking to innovate, collaborate, and engage with the startup community, C4DI offers tailored corporate packages. From strategic partnerships to innovation labs and flexible team spaces, we help corporate teams tap into new ideas and accelerate their digital transformation.

Ideal for: Established businesses seeking to innovate, collaborate, and evolve.

We’re more than just a workspace.

We’re a thriving community of tech innovators, entrepreneurs, and forward-thinking businesses.

Book a Tour

Whether you’re a student, a startup, an entrepreneur, or a growing business, you’ll find your place here.